How to Reduce PC Power Consumption

You probably grew up having a parent saying, “turn the lights off!” That was the number-one way to save on the power bill. But now, with so many of us having personal computers in the home, they too are a big electricity drain. Try these strategies to cut your PC power consumption. Unplug the extras […]

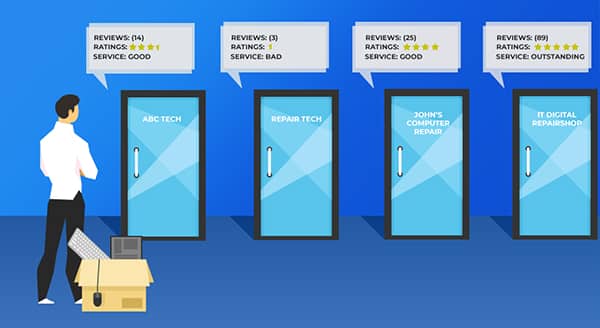

How to Select a Computer Repair Business

Something is broken! The laptop is whirring. The computer won’t power up. In either case, you’re staring at a blank, blue screen. Yet you can’t live without your computer. You need to find a computer repair business. But what should you look for? This article will help you make your choice. If a computer or […]

Refurbished Computer and Laptops Worth Another Look?

If you’re in the market for a new computer or laptop, you’ve likely noticed a few things. Technology is more expensive, and there are long waits to get the devices you want. This article will explain the current computer and laptop supply-chain issues. Then, we’ll offer reasons to consider refurbished devices to meet your needs. […]

Picking a PC for Video Editing

Ready to be the next TikTok breakout? Or perhaps you want a video of your cockatoo “singing” “Amazing Grace” to go viral. Or you may make company promotional videos while working from home. There are many reasons you might be looking for the right home computer to do video editing. This article will help. Yes, […]

Psst … What’s Your Master Password?

All of us like to think we are unique. That thinking extends to our passwords too, right? We’re special and distinct, so no one could guess our chosen collection of letters, numbers and symbols. Well, it’s surprisingly easy for algorithms to determine passwords and to do so extremely quickly. So, a password manager is a […]

Picking Your Home PC browser: Chrome vs. Edge

Selecting your home computer was challenging enough. Now, we’re asking you to decide on the right PC browser, too? When will the decisions end? At least we’re making the comparison easier. This article helps you decide if Google Chrome or Microsoft Edge works best for you. It’s estimated that the average individual spends almost a […]

Tech Tips for Small Business Owners in 2022

A new year is a chance for a fresh beginning. To that end, try these tech tips for small business owners to kick 2022 off right. First, launch a successful new year for your business by going mobile. Agility is one of the key differentiators of a small business. Be more flexible than larger competitors […]

How to Safely Retire Old Devices

It’s inevitable that we’ll retire old devices to upgrade to the latest and greatest. A new laptop, desktop, or phone is exciting. Yet, before you get too distracted by your shiny, new device, take the time to safely retire the old one. When buying the new device you may take trade-in value. Otherwise, you may […]

7 Common Business IT Myths Debunked

MythBuster programs on television never focus on business misconceptions about IT. Too bad, because believing these myths can be both costly and dangerous to your business. This article debunks seven common business IT myths. Sometimes myths are harmless, but when it comes to business IT myths, not knowing the truth is damaging. Make smarter tech […]

How to Free Up IT Resources

Business success comes from capitalizing on opportunities, except it is harder to do so if you are resource constrained. This article explores ways to free up IT resources to drive productivity and evolution. Your business depends on information technology resources. The right software can help manage expanding workloads and improve collaboration. Enjoy reliable, secure access […]